Let's face it, entrepreneurs - venturing into the startup world is like agreeing to ride a rollercoaster that's had one too many shots of espresso.

You're there for the thrills, the spills, and that intoxicating sense of freedom.

But what if I told you, amidst the chaos of seeking venture capital and the relentless pursuit of the next big thing, there's a different path often left untrodden?

Welcome to bootstrapping a startup, a journey where the only investor you're answering to is yourself, sipping wine at 3 pm because, why not?

You're there for the thrills, the spills, and that intoxicating sense of freedom.

But what if I told you, amidst the chaos of seeking venture capital and the relentless pursuit of the next big thing, there's a different path often left untrodden?

Welcome to bootstrapping a startup, a journey where the only investor you're answering to is yourself, sipping wine at 3 pm because, why not?

What does bootstrapping even mean?

Bootstrapping is a concept that is not often discussed in startup books and accelerators, despite it being a solid way of building startups. Imagine this: embarking on the grand adventure of creating your startup entirely on your own steam. No sugar daddies, no fairy godmothers, just you, your wits, and perhaps a stash of emergency coffee (or wine, depending on the time of day!) to fuel the journey. Bootstrapping is akin to crafting a gourmet meal with whatever's in your fridge because you're determined not to step foot in a grocery store (or, heaven forbid, borrow sugar from a neighbor).

Translated from the old wise tale of pulling oneself up by one's bootstraps, in the entrepreneurial realm, it means running with your innovative idea without splashing in the investor pool. It's about being the captain of your own ship, navigating through the startup seas with the treasure map you drew yourself. It involves channeling your inner MacGyver to creatively fund and frugally manage your startup, using personal savings, early-stage business revenue (that's right, every euro counts) and some government grants to keep you afloat until profitability.

This self-feeling journey of bootstrapping is not just about saving money; nor is it only for those that got rejected by VCs. More and more, bootstrapping is becoming a deliberate choice for independence, keeping your enterprise's steering wheel firmly in your hands. You grow at your pace, maybe slower, but definitely wiser. It's like having a baby and deciding to knit every piece of clothing by hand — it's personal, it's heart-driven, and it teaches you the value of every stitch.

Translated from the old wise tale of pulling oneself up by one's bootstraps, in the entrepreneurial realm, it means running with your innovative idea without splashing in the investor pool. It's about being the captain of your own ship, navigating through the startup seas with the treasure map you drew yourself. It involves channeling your inner MacGyver to creatively fund and frugally manage your startup, using personal savings, early-stage business revenue (that's right, every euro counts) and some government grants to keep you afloat until profitability.

This self-feeling journey of bootstrapping is not just about saving money; nor is it only for those that got rejected by VCs. More and more, bootstrapping is becoming a deliberate choice for independence, keeping your enterprise's steering wheel firmly in your hands. You grow at your pace, maybe slower, but definitely wiser. It's like having a baby and deciding to knit every piece of clothing by hand — it's personal, it's heart-driven, and it teaches you the value of every stitch.

The Dream Team Conundrum

Let's start with a topic that's as elusive as the Yeti - the mythical "Dream Team" investors are seemingly always on the hunt for. Picture this: a squad that's a perfect blend of Steve Jobs' vision, Elon Musk's audacity, and the technical prowess of, well, the entire Google dev team (minus their recent screw up with Gemini). Sounds dreamy, right? Here's the rub: most of us don't fit this fairy tale narrative. And that's perfectly okay.

My team is quite the opposite of what investors usually want: I am happily married to my co-founder (and that's a big red flag for investors), my CTO doesn't have fancy degrees and our Chief AI Officer is not even human. While you can easily pivot your business idea and change the business model, you don't really want to divorce your husband because investors think that married co-founders is too much of a risk. Once at an event, a VC told me exactly that "married co-founders is a red flag" and in a few minutes he said he needed to rush back home before his wife got pissed at him. The irony is quite clear.

When we applied for EU grants and it took the evaluators more than six months to come back with the verdict, we were told that we lacked previous experience in building games, so they didn't think we were capable of pulling it off and they denied the grant. Needless to say that we had a big laugh because by that time we had already built the game and people were using it. Check out my article in Sifted that goes into details of EU grants and how unsuitable they are for most startups.

My team is quite the opposite of what investors usually want: I am happily married to my co-founder (and that's a big red flag for investors), my CTO doesn't have fancy degrees and our Chief AI Officer is not even human. While you can easily pivot your business idea and change the business model, you don't really want to divorce your husband because investors think that married co-founders is too much of a risk. Once at an event, a VC told me exactly that "married co-founders is a red flag" and in a few minutes he said he needed to rush back home before his wife got pissed at him. The irony is quite clear.

When we applied for EU grants and it took the evaluators more than six months to come back with the verdict, we were told that we lacked previous experience in building games, so they didn't think we were capable of pulling it off and they denied the grant. Needless to say that we had a big laugh because by that time we had already built the game and people were using it. Check out my article in Sifted that goes into details of EU grants and how unsuitable they are for most startups.

Are you ready to hit the ground running and build your startup empire?

Jump into Fe/male Switch, a unique startup game, and transform from a rookie to a business rockstar—all while having a splendid time. It's risk-free, it's enlightening, it's a riot. And we have PlayPals.

Why this obsession with a perfect team, you ask? Well, investors love to bet on a sure thing (or what looks like one in their eyes), and this "Dream Team" often becomes the emblem of a no-fail venture. But here's the kicker - innovation doesn't come from mirroring Silicon Valley’s Most Wanted. It comes from diverse perspectives, from teams that argue over pizza toppings (of course it has to be quattro formaggi) but agree on changing the world.

So, if you find yourself outside the cookie-cutter mold of a "Dream Team", don't worry too much about it. Because your uniqueness is not a weakness; it's just the way it is and you need to get the best out of it. And bootstrapping means betting on yourself and moving forward when all the odds are against you. If eventually at some point you decide to move from bootstrapping to Venture Capital (which is a great strategy but you need to be smart about it), you will have more leverage because you will already have a product and paying customers and not just an MVP and a waitlist with 2 people on it. This means that you won't have to give away half the company (and lose control) for a few hundreds of euros.

The rejected and burned out entrepreneur

Entrepreneurs fail, they get rejected and they end up with a burnout and a divorce. Do you still want to dive into the startup ocean? Let's paint a Picasso here: "99% of first-time entrepreneurs are basically flailing about with no floaties." It's a wild world where most of us don't have a fancy Stanford badge or a Google alumni tee. Been there, almost got the t-shirt. This chapter of our story is about those grim statistics that are supposed to make us quake but end up fueling our fire. It took me a few years to finally see the whole picture. I still don't understand why I was only given some pieces of the puzzle by all the incubators that I participated in. I had to figure the rest out by myself and it almost broke me physically. Now that I know that I have options, I'm the happiest I have ever been.

Here's something that startup founders should know: not every startup is a great fit for VCs. That does not mean that it's not a great startup. It just means that it is probably not a business that is capable of bringing the magic 10x to investors.

Venture capital is not for the faint of heart. It's a high-risk, high-reward game, and those who play it are looking for investments that don't just return a smidgen over the principal amount. They're hunting for the unicorns, the rare jewels that can skyrocket in value and make all the risks worth it. Essentially, they're looking for startups that can provide a return of 10 times their initial investment, or in a fancier startup lingo, a 10x return.

So, how does this 10x thing work in the VC world? Imagine a VC firm splurging €1 million on your sparkling new startup. Given the risky nature of startups, where many falter and find themselves six feet under in Startup Cemetery, VCs fund multiple ventures hoping a few will not just succeed but flourish. Now, if your startup hits it big and becomes the new darling of Silicon Valley, that €1 million could turn into €10 million or more, thereby covering the losses from less fortunate investments and securing a hefty profit for the fund.

But why only go for startups that can potentially gift them this lucrative 10x return? Well, it's all about the economics of venture capital. The VC world is akin to holding a basket of eggs, some of which are bound to hatch into golden geese (or fire-breathing dragons, depending on your fantasy of choice) while many others... well, let's just say they won't even make it to the omelet station. The successes need to not only cover the cost of the failures but also provide a substantial return to the investors for their risk and to the fund itself.

This strategy sets a high bar for startups seeking VC funding. Investors meticulously search for ventures with the potential to disrupt markets, scale rapidly, and have a significant competitive edge—ones that can redefine industries and consumer behaviors. So, if a startup doesn’t make the VC’s senses tingle with the anticipation of a 10x return, it’s usually a hard pass. So what do you do then?

Here's something that startup founders should know: not every startup is a great fit for VCs. That does not mean that it's not a great startup. It just means that it is probably not a business that is capable of bringing the magic 10x to investors.

Venture capital is not for the faint of heart. It's a high-risk, high-reward game, and those who play it are looking for investments that don't just return a smidgen over the principal amount. They're hunting for the unicorns, the rare jewels that can skyrocket in value and make all the risks worth it. Essentially, they're looking for startups that can provide a return of 10 times their initial investment, or in a fancier startup lingo, a 10x return.

So, how does this 10x thing work in the VC world? Imagine a VC firm splurging €1 million on your sparkling new startup. Given the risky nature of startups, where many falter and find themselves six feet under in Startup Cemetery, VCs fund multiple ventures hoping a few will not just succeed but flourish. Now, if your startup hits it big and becomes the new darling of Silicon Valley, that €1 million could turn into €10 million or more, thereby covering the losses from less fortunate investments and securing a hefty profit for the fund.

But why only go for startups that can potentially gift them this lucrative 10x return? Well, it's all about the economics of venture capital. The VC world is akin to holding a basket of eggs, some of which are bound to hatch into golden geese (or fire-breathing dragons, depending on your fantasy of choice) while many others... well, let's just say they won't even make it to the omelet station. The successes need to not only cover the cost of the failures but also provide a substantial return to the investors for their risk and to the fund itself.

This strategy sets a high bar for startups seeking VC funding. Investors meticulously search for ventures with the potential to disrupt markets, scale rapidly, and have a significant competitive edge—ones that can redefine industries and consumer behaviors. So, if a startup doesn’t make the VC’s senses tingle with the anticipation of a 10x return, it’s usually a hard pass. So what do you do then?

BAAS - Bootstrapping As A Strategy

Moving on to our knight in shining armor - BAAS (I think it sounds fun: I'm building SAAS using BAAS). Imagine holding the reins, keeping your equity close, and maybe, just maybe, not losing your marbles. Achieving product-market fit without throwing cash off a rooftop sounds like a dream, right? Plus, you get to wave this in the face of future investors, showing off your shiny self-sustained venture.

The Market & GTM Tango

Here comes the fun bit - dancing into the market with the grace of a slightly tipsy ballerina. Being a bootstrapper means you're the MacGyver of marketing. SEO and #buildinpublic are your best friends to get started with organic growth. Dive into niches like you dive into a pool of chocolate; it's sweet, less crowded, and you stand out just by being your fabulous self. And it costs nothing in euros. You pay with your time and in exchange you get experience. Something that takes you a week today will only take you an hour in six months, so it's definitelly a journey worth taking.

For those of you from the Netherlands, you might recognize the man on the photo. I love this picture not only because it's not every day that you meet royalty, but for what it stands. I was on my way to a hospital in Maastricht to get a head MRI and find out if I had a brain tumor and was going to die (good news, no tumor) and coincidentally Prince Constantijn was at an event at a venue nearby. I stopped by, surrounded by men in suits. When he got off stage and was walking past me, I just stepped in front of him and asked if he could take a photo with me to support female entrepreneurship. He did and now I have a fancy photo I can put on my website for credibility building. You see how easy that was? Just get a debilitating headache that doesn't let you sleep for months and you got yourself a photo with a celebrity. Easy-peasy!

You see what I mean when I say that you got to do more with less and be super creative? It's a state of mind and to some extent having no money in the company bank account is a catalyst to your creativity. You risk more when you have nothing to lose. The worst that can happen is that your startup fails and you join a big crowd of other failed entrepreneurs. So what? Nobody said it was going to be easy, but it sure as hell must feel fun, otherwise entrepreneurship will eat you alive.

For those of you from the Netherlands, you might recognize the man on the photo. I love this picture not only because it's not every day that you meet royalty, but for what it stands. I was on my way to a hospital in Maastricht to get a head MRI and find out if I had a brain tumor and was going to die (good news, no tumor) and coincidentally Prince Constantijn was at an event at a venue nearby. I stopped by, surrounded by men in suits. When he got off stage and was walking past me, I just stepped in front of him and asked if he could take a photo with me to support female entrepreneurship. He did and now I have a fancy photo I can put on my website for credibility building. You see how easy that was? Just get a debilitating headache that doesn't let you sleep for months and you got yourself a photo with a celebrity. Easy-peasy!

You see what I mean when I say that you got to do more with less and be super creative? It's a state of mind and to some extent having no money in the company bank account is a catalyst to your creativity. You risk more when you have nothing to lose. The worst that can happen is that your startup fails and you join a big crowd of other failed entrepreneurs. So what? Nobody said it was going to be easy, but it sure as hell must feel fun, otherwise entrepreneurship will eat you alive.

Ready to level up your startup without the equity hassle?

Embrace the power of our AI co-founder tools at Fe/male Switch and let artificial intelligence handle the grunt work. Say goodbye to startup name headaches, logo design meltdown, and idea generation blocks. With our AI at your service, you’ll be free to focus on what really matters – growing your business. Swing by our digital workshop today and meet your new AI teammates!

Product Development with zero code

Listen up, folks; who said you need to be the next Zuckerberg to build cool stuff? Not I! Master zero code platforms, and suddenly, you're making more MVPs than there are memes about cats. It's all about building smarter, not harder. And when you're bootstrapping, this isn't just advice; it's gospel.

Heard about zero code? If not, start googling now. You are missing the last train. You don't need to immediately hire a team of devs, just use Make, Tilda, Bubble and Tally and you can build yourself a very decent MVP at a fraction of the costs of traditional development.

And I am a big fan of engineering as marketing, when you build simple free tools that are related to your main product and share them with people. They give you traffic and warm people up towards your paid offer. We have plenty of these tools and are building more and more. Check out one of the most popular tools we have that's called Entrepreneurial potential.

Heard about zero code? If not, start googling now. You are missing the last train. You don't need to immediately hire a team of devs, just use Make, Tilda, Bubble and Tally and you can build yourself a very decent MVP at a fraction of the costs of traditional development.

And I am a big fan of engineering as marketing, when you build simple free tools that are related to your main product and share them with people. They give you traffic and warm people up towards your paid offer. We have plenty of these tools and are building more and more. Check out one of the most popular tools we have that's called Entrepreneurial potential.

Business Models Are Like Ice Cream: gotta try a few to find your favourite

Let's lay it down — traditional business models are so passé. B2C, one-time payments, even being a proud copycat is on the table, because why not? It's like a buffet, and you've got the ultimate hall pass. Embrace the wackiness, because who doesn't love ice cream, especially with odd flavors like 'Open Source SaaS'?

When bootstrapping a startup, you can break all the so-called rules that are imposed by investors. Do only B2B, have a super unique selling proposition, use only subscriptions because then you can show your MRR and ARR and so on. No, thank you. I'm going to do what's best for my business and let the market decide.

When bootstrapping a startup, you can break all the so-called rules that are imposed by investors. Do only B2B, have a super unique selling proposition, use only subscriptions because then you can show your MRR and ARR and so on. No, thank you. I'm going to do what's best for my business and let the market decide.

Traction or How Cash Became King Again

Alright, what's next? Vanity metrics are like cotton candy; they look good, but there's no substance. Think about the number of followers on your social media page (with engagement being a better metric than the number of followers), reels that go viral but bring no customers, number of your website visitors, number of your app installs. So, in general, everything that doesn't end up bringing value to your business is a useless metric, but, of course, even vanity metrics have their value, for example from the PR point of view. And then there's valuation, the queen of vanity metrics.

Think of valuation as the startup world's version of a high school popularity contest—it's all about how much everyone thinks you're worth. In essence, it's a financial figure that investors and owners slap onto a business based on its current assets, earning potential, and often, a hefty dose of optimism about future growth. Now, why is this whole valuation rigmarole as useful as a chocolate teapot for us bootstrappers? Simple, my darlings. When you're bootstrapping, you're not frolicking in the VC playground looking for investors to fund your dreams in exchange for a piece of your kingdom. You're the ruler, the financier, the chief bottle-washer—everything runs on your own dime. So, the traditional notion of valuation, with all its speculative charm, doesn't quite fit into the bootstrap ethos where cash flow, survival, and sustainable growth take center stage, not hypothetical billions. In the bootstrapped universe, what matters most is building something solid, something real—like your revenue, profitability, and customer loyalty—not just a number that makes for a good bedtime story.

Cash flow, on the other hand, is the steak dinner with all the trimmings. Bootstrapping teaches us to relish the small wins, and honestly, there's nothing quite as satisfying as proving you can survive another month and thrive.

Think of valuation as the startup world's version of a high school popularity contest—it's all about how much everyone thinks you're worth. In essence, it's a financial figure that investors and owners slap onto a business based on its current assets, earning potential, and often, a hefty dose of optimism about future growth. Now, why is this whole valuation rigmarole as useful as a chocolate teapot for us bootstrappers? Simple, my darlings. When you're bootstrapping, you're not frolicking in the VC playground looking for investors to fund your dreams in exchange for a piece of your kingdom. You're the ruler, the financier, the chief bottle-washer—everything runs on your own dime. So, the traditional notion of valuation, with all its speculative charm, doesn't quite fit into the bootstrap ethos where cash flow, survival, and sustainable growth take center stage, not hypothetical billions. In the bootstrapped universe, what matters most is building something solid, something real—like your revenue, profitability, and customer loyalty—not just a number that makes for a good bedtime story.

Cash flow, on the other hand, is the steak dinner with all the trimmings. Bootstrapping teaches us to relish the small wins, and honestly, there's nothing quite as satisfying as proving you can survive another month and thrive.

Financial Kung-Fu: The Art of Stretching a Dollar

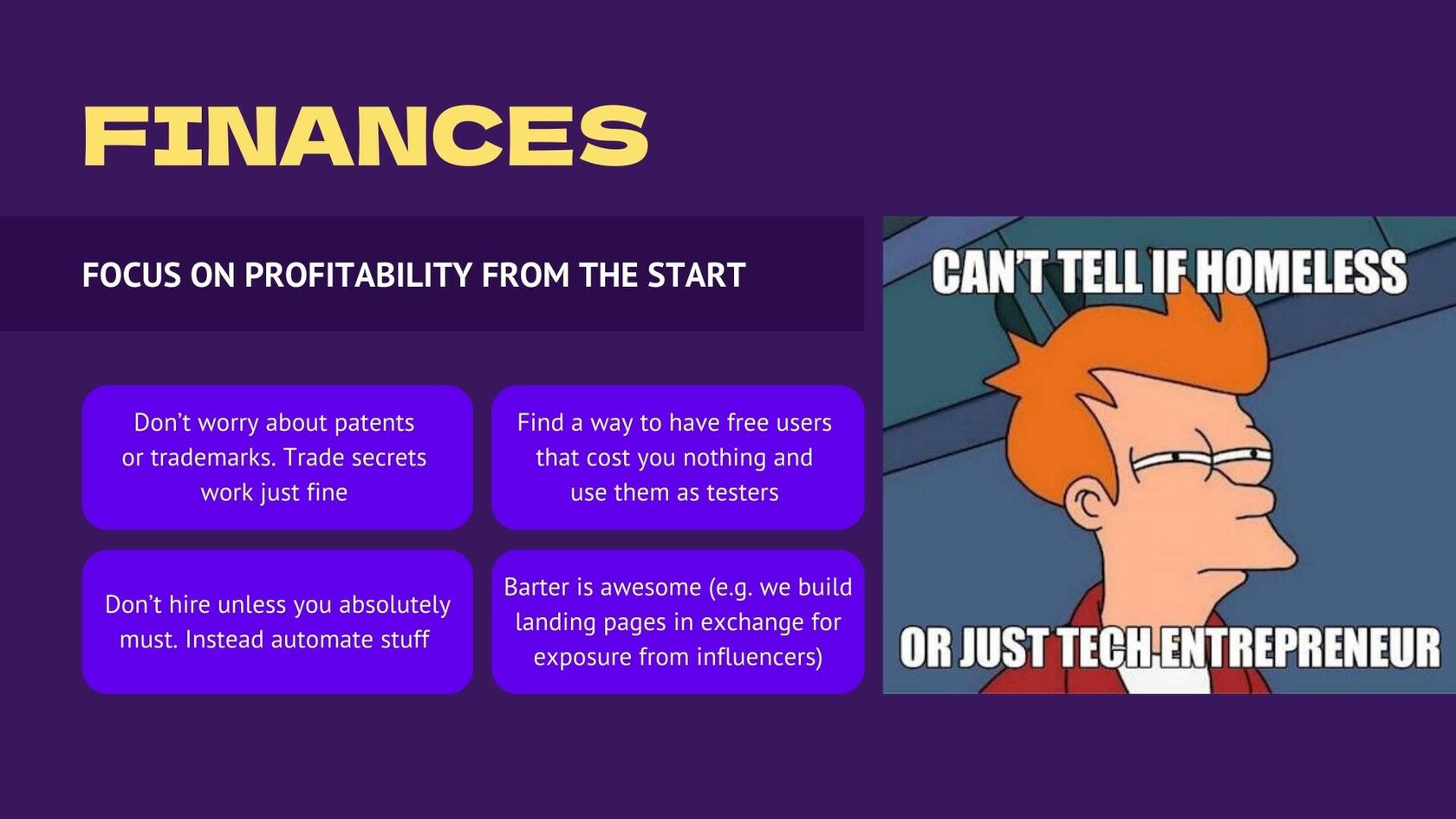

Forget patents and trademarks; it's all about trade secrets, which is free and easy. Read up on IP protection for startups here. This saves you so much money at a stage when you need to figure out the market and not the patent attorneys. You need to get as much free stuff as you can to stay afloat.

One fun trick is bartering, like in the olden days. Need marketing? Trade a skill that you have for something that you need. It's resourcefulness on steroids. For example, we built a landing page in exchange for a social media ad and that got us 200 users in one day.

Also, try not to hire unless you absolutely need to. Hiring is fun, but firing someone when you can't afford their salary is not. Same goes for getting a co-founder just for the sake of getting one. Partner up with AI and build as much as you can. There's so much you can do these days with AI and zero code, that it's mind blowing.

Also, automate, automate, automate. Because who needs sleepless nights when you've got bots doing the grunt work? People can be also super useful, so why not let people use your product for free in exchange for feedback if you don't have enough hands to test and find all the bugs?

One fun trick is bartering, like in the olden days. Need marketing? Trade a skill that you have for something that you need. It's resourcefulness on steroids. For example, we built a landing page in exchange for a social media ad and that got us 200 users in one day.

Also, try not to hire unless you absolutely need to. Hiring is fun, but firing someone when you can't afford their salary is not. Same goes for getting a co-founder just for the sake of getting one. Partner up with AI and build as much as you can. There's so much you can do these days with AI and zero code, that it's mind blowing.

Also, automate, automate, automate. Because who needs sleepless nights when you've got bots doing the grunt work? People can be also super useful, so why not let people use your product for free in exchange for feedback if you don't have enough hands to test and find all the bugs?

Embark on an epic entrepreneurial journey with our free startup school.

Cast aside your apprehensions and step into a world where startup skills are your spells and market victories your conquests. Join our startup school today while it's free.

Funding - Who Needs VCs When You've Got Creativity?

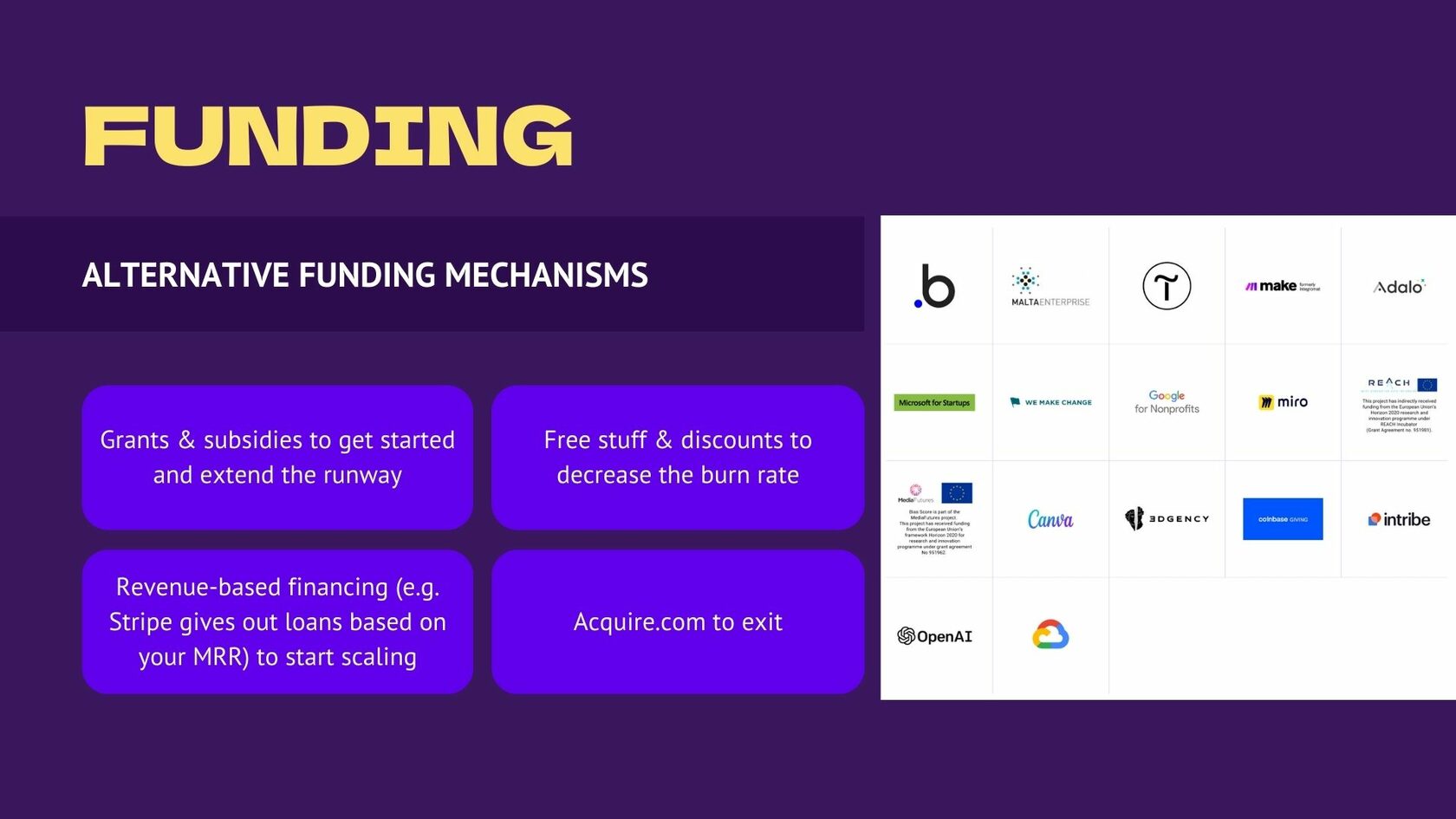

Grants, subsidies, and even the magical world of revenue-based financing are where it's at. It's like finding a treasure chest but without having to sell your soul to pirates (a.k.a. investors). Think of it as scaling on your terms, which sounds like freedom sprinkled with a dash of rebellion.

There are multiple alternatives to VC funding that are a great fit for bootstrappers. Get free software from programs like Google for Startups and Microsoft Founders Hub, partner with other startups and exchange services. And of course there are grants but be careful: the paperwork that comes with them is huge and you will lose a lot of time on that.

Once you found Product Markey Fit and it's time to scale, you can decide to check out investors and see what they are offering. Or you can always exit. Platforms like Acquire.com exist and usually you can sell your business for 3 times your ARR (the amount of money your company makes per year). It's always nice to have options.

There are multiple alternatives to VC funding that are a great fit for bootstrappers. Get free software from programs like Google for Startups and Microsoft Founders Hub, partner with other startups and exchange services. And of course there are grants but be careful: the paperwork that comes with them is huge and you will lose a lot of time on that.

Once you found Product Markey Fit and it's time to scale, you can decide to check out investors and see what they are offering. Or you can always exit. Platforms like Acquire.com exist and usually you can sell your business for 3 times your ARR (the amount of money your company makes per year). It's always nice to have options.

The Grand Finale: Why Now?

Here's to more women crashing the startup party, to AI doing the heavy lifting, and to building communities that actually care. I am 100% sure the future is zero code, sprinkled with a lot of AI magic and a lot of automations. And in this future, my dear future moguls, 99% of MVPs won't need a venture capitalist lurking around. They'll need you and your creativity. And a community around you, of course.

Bootstrapping isn't just an alternative; it's a manifesto for freedom, innovation, and a bit of cheek. So go ahead, pour that glass of wine (or water), and remember: in the world of startups, the pen — or should I say, the laptop — is mightier than the venture capital sword. Cheers to that!

And remember, if you ever find yourself needing a bit of guidance or a hearty laugh, swing by Fe/male Switch. We're all about empowering the rebels, the dreamers, and yes, the bootstrappers. See you there! MeanCEO out.

FAQ about bootstrapping

What is bootstrapping in startup terms, really?

How to bootstrap a startup with zero funds?

Are there benefits to bootstrapping a business?

Bootstrapped company success stories: Fact or Fiction?

Can you achieve rapid growth with bootstrapping?

What are the biggest challenges of bootstrapping a startup?

Creative financing for bootstrapped startups: Any tips?

Maintaining control in bootstrapped startups: Myth or reality?

How to scale a business with bootstrapping techniques?

When is it time to transition from bootstrapping to seeking investment?

- Picture this: You, the fearless entrepreneur, diving headfirst into the startup world, fuelled by nothing but your wit, charm, and a tightly clutched wallet. Bootstrapping means shooting for the stars on a budget tighter than your favourite jeans. It's all about self-funding your way to success, no venture capital strings attached. Check more here on launching a product without any money.

How to bootstrap a startup with zero funds?

- Ah, the art of making something out of (almost) nothing. It starts with leveraging what you have - think skills, time, and bucket loads of creativity. Dive into the world of free tools, swap services, and don't overlook the magic of early customer sales. Remember, your biggest asset is your audacity to try. And definitely don't build anything until you have people willing to pay for it. Read up on validating stuff without building anything.

Are there benefits to bootstrapping a business?

- Oh, honey, where do I start? Imagine holding onto every sliver of equity in your company, making decisions at the snap of your fingers, and truly owning your vision. It’s like being the monarch of your own kingdom, without knights (investors) questioning your every move. The only people who you should listen to are your paying customers.

Bootstrapped company success stories: Fact or Fiction?

- They’re as real as the ground beneath our feet! From tech titans to garage-bound geniuses, the business landscape is dotted with tales of bootstrapped ventures that hit the jackpot without bowing to the altar of external funding. Let these stories be your bedtime fairy tales as you dream big.

Can you achieve rapid growth with bootstrapping?

- Absolutely! While you won't be zipping along on a rocket, you can certainly rev up your engines with smart strategies. It's about playing the long game, focusing on sustainable growth, and intimately knowing your audience. Think tortoise, not hare, but with a jetpack strapped on eventually.

What are the biggest challenges of bootstrapping a startup?

- Oh, the drama! Picture managing cash flow tighter than a reality TV show budget, wearing more hats than there are in a hat shop, and learning resilience the hard way. Yet, dear heart, it’s these very challenges that mold you into the startup superstar you’re destined to become.

Creative financing for bootstrapped startups: Any tips?

- Get ready to be the MacGyver of startup financing. From pre-sales wonders and crowdfunding feats to grants and contests rewards - the world's your oyster, shuck it! Innovation isn’t just for your product; apply it to your fundraising game too.

Maintaining control in bootstrapped startups: Myth or reality?

- As real as the ambition in your eyes! When you’re the bank, the CEO, and the janitor all rolled into one, you call the shots. No need to dilute your vision or compromise for the sake of pleasing the investor choir. It's your ship; you steer it where you want it to go. Try not to crash it, though.

How to scale a business with bootstrapping techniques?

- Scaling while bootstrapping is like fueling a spaceship with recycled rocket fuel. It takes ingenuity, growth hacking, mastering the fine art of customer retention, and perhaps a sprinkle of alchemy. Focus on building a solid base, then reach for the stars one step at a time.

When is it time to transition from bootstrapping to seeking investment?

- Ah, the eternal question: To VC or not to VC? It’s time to consider external funding when you’ve squeezed every drop of juice from bootstrapping and you're staring at opportunities bigger than your current wallet. It's not selling out; it's leveling up—with wisdom and more bargaining power. After all, dearest, it's about making your empire as boundless as your dreams.

Subscribe to receive Fe/male Switch's newsletter — your bi-monthly scroll of startup secrets, freshly conjured advice, and the latest magical AI tools. Crafted by Elona and curated by Mean CEO, it’s your exclusive gateway to entrepreneurial prowess. Sign up now and never miss a beat from the startup sorcery world!